In today’s competitive housing market it is not uncommon for home owners to receive multiple offers on a listing. With houses going in contract in less than a week, some buyers get anxious and offer substantially more than list price to secure the contract.

That’s great news for sellers, however, it can lead to unexpected challenges that will delay the purchase or sale of your home. The biggest challenge often concerns the property appraisal.

The Appraisal Challenge

Whether you bid above asking price or the home you want to buy was listed for more than it’s really worth, the house must appraise for a bank to loan you money. The majority of appraisals comes in at the purchase price written in your contract. But there is no guarantee.

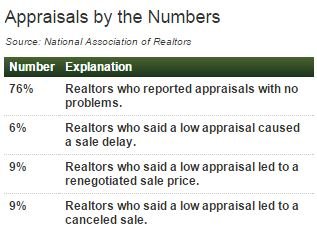

According to the National Association of Realtors (NAR) 24% of all appraisals are lower than the contract price. They cause a delay in the purchase or result in a canceled sale.

According to the National Association of Realtors (NAR) 24% of all appraisals are lower than the contract price. They cause a delay in the purchase or result in a canceled sale.

Appraisers are very cautious these days. They don’t like to go out on a limb and overvalue a property without solid justification. Even custom home builders are struggling with that challenge.

If the appraisal comes in below the purchase price, your lender will base the loan amount on the appraised value not the contract price. In that case you will have to pay the difference in cash or get the seller to agree on a lower purchase price.

That’s why many contracts include appraisal contingencies.

Low appraisals cause problems for both buyers and sellers. What hurts the seller is the fact that VA and FHA appraisals stay with the property for 6 months. This means that other buyers using FHA or VA financing have to go with that low appraisal. This limits the number of potential buyers for your house.

Can You Challenge an Appraisal?

Yes, you can. It is not easy. Lenders are not allowed to communicate directly with the appraiser. But there are steps you can take with the support of your real estate agent.

If you want to challenge an appraisal, your agent should compile an accurate list of comparable sales from the past 6 months. The seller needs to provide a detailed list (including the cost) of upgrades done to the property in the past 12 months. The combination of upgrades and comparables must clearly demonstrate that the purchase price is justified.

If you want to pay more, because you had to compete against other buyers, the appraiser will most likely not change his mind.

Here are a few more tips on How to Challenge an Appraisal.

Why You Must Stay Cool in a Hot Market

When you overpay for a property, you are betting on home values to continue to rise. That’s what buyers did 10 years ago until the housing bubble burst in 2007.

Don’t do it! You will lose a lot of money, if you have to sell your house.

Instead, call or text me at (614) 975-9650. As your trusted Realtor I understand local market conditions. Let me help you AVOID appraisal problems!

As your buyer’s agent I will give you the data to write an educated offer that represents the true market value of the home. This may mean that you have to walk away from a house that’s overpriced due to multiple offers.

As your listing agent I will explain how to price your home correctly to avoid appraisal challenges when you get an offer.