The Trump Administration’s proposed tax law will impact homeowners in 3 ways:

- Mortgage interest deductions will be capped

- Local property taxes cannot be fully deducted, and

- The capital gains exemption when you sell your home will be more difficult to get.

Here are the details …

Mortgage Interest Tax Deduction

The proposed law would eliminate the mortgage interest deduction over $500,000. This means home buyers could not deduct interest on the portions of their loans above $500K. If you make a down payment of 20%, you could still buy a $625,000 home and would be able to deduct all of your mortgage interest.

The impact of this change will be minimal in Columbus. The average sales price is currently less than $230,000. Out of 32,900 residential properties sold in Central Ohio in the past 12 months, only 682 were more expensive than $625K.

2.1% of home buyers would be affected by the new tax law.

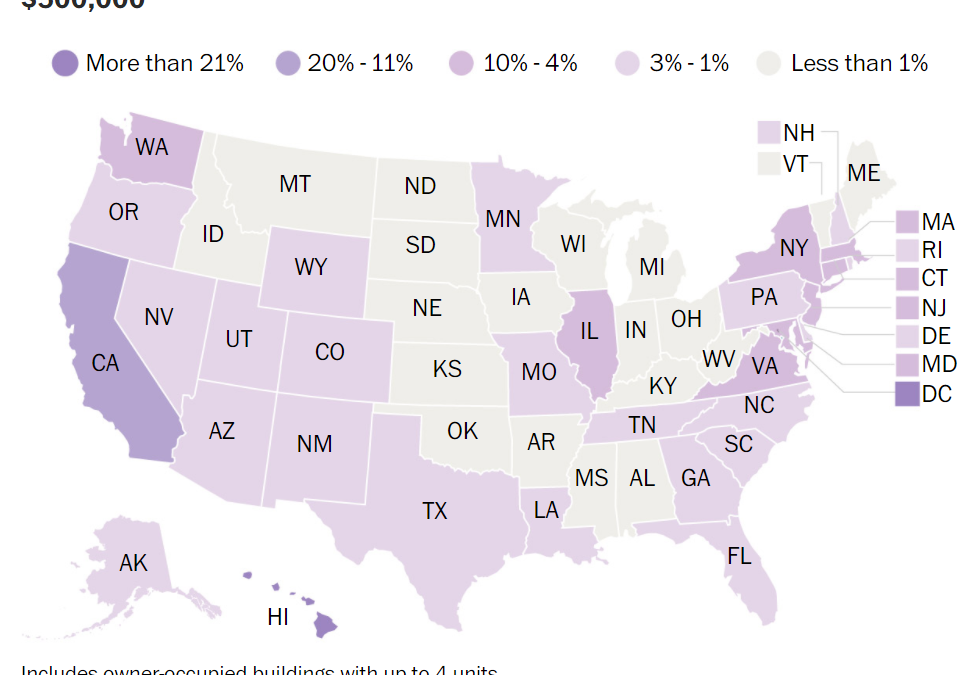

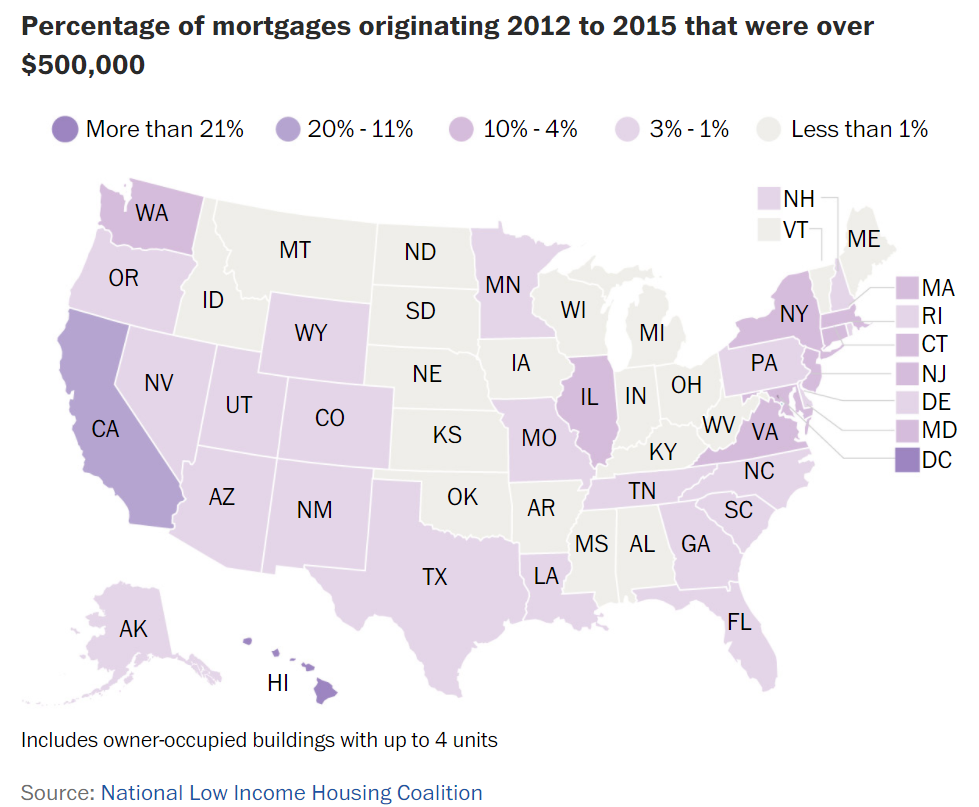

This map shows which states have the highest percent of mortgages over $500,000.

Property Taxes

The proposed law was supposed to eliminate deductions of all state and local taxes. However, you would still be able to deduct up to $10,000 of the property taxes you pay.

This will impact homeowners in the suburbs. For instance, property taxes for a home valued around $350,000 in Dublin exceed $10,000.

This would also impact homeowners who are subject to school income taxes. Many rural communities charge lower property taxes than Columbus and most suburbs. However, they charge school income taxes, which would not be deductible under the new plan.

Capital Gains Exemption

The current tax law allows homeowners to exclude up to $250,000 in capital gains ($500,000 for married couples) from the sale of their primary residence. Under the new plan homeowners must have owned and lived in the property for at least five of the last eight years. Currently, the rule is two of the last five.

Taxpayers’ use of the exemption would be limited to one sale every five years, rather than one every two. In addition, you would lose the gains exemption, if your adjusted gross income exceeds $500,000 for married couples, or $250,000 if single.

The changes in the capital gains exemption gives home owners even less incentive to sell. And that’s not going to help with our inventory crisis.

Overcome the uncertainties of the new tax plan and list your home NOW!

Call or text me at (614) 975-9650!