I just want to send you a quick update from the mortgage interest front.

You probably heard that interest rates will rise in 2022. Many experts predicted that the 30-year fixed rate will increase to 3.8% by the end of this year.

Unfortunately, their predictions were wrong …

The interest rate for a 30-year mortgage has skyrocketed to 4.1%.

With inflation hitting 7% in December and January, we expect that interest rates will continue to rise.

How Housing Affordability Suffers

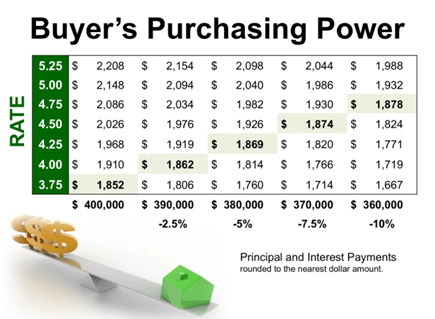

Our friends at Ruoff Mortgage sent me the chart below. It shows how each 0.25% rate increase will impact your mortgage payments.

Rates have increased by almost 1% in the past 6 months, which corresponds to a $200 increase in your monthly mortgage payment. This can be the difference between getting approved or not getting approved for a purchase loan.

Due to the 1% hike in interest rates your purchasing power has dropped by $40,000 (10%), and you will have to look for less expensive homes.

What Should Buyers Do?

Start your home search immediately! At 4% interest rates are still at historic lows, however, there’s a high probability they will rise higher.

At the same time I do not expect home values to drop. There’s too much demand and not enough supply.

As of today, there are only 1,587 active listings in all of Central Ohio, almost 10% fewer than a year ago.

Do NOT delay your dream of home ownership!

Call or Text me TODAY at (614) 975-9650!