Most people are not thinking about buying a house in December. They are busy preparing for the Holidays, attending Christmas parties, and buying presents for their loved ones.

Let me share with you 3 reasons why purchasing a home before the end of the year could save you tens of thousands of dollars and substantially increase your wealth.

Interest Rate Hikes

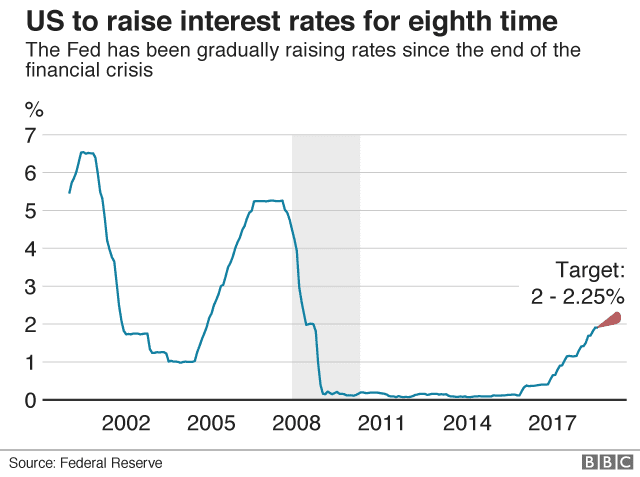

I am sure you noticed how interest rates have been going up over the past 12 months. The Federal Reserve is considering another rate increase in December.

Right now, the interest rate on a 30-year fixed mortgage is around 4.8%.

At 4.8% your monthly payment (principal & interest) on a $300,000 loan is $1,574. A rate hike of 1% would increase your monthly payment to $1,760.

You would have to pay an extra $186 a month.

If you stay in your house for 10 years this would cost you an additional $22,320.

Use this mortgage calculator to estimate the numbers for your specific circumstance.

Savings by acting now: $22,320 over 10 years.

Home Value Appreciation & Seasonal Discounts

The average sales price of Central Ohio Homes has increased by 6.4% in the past 12 months. The National Association of Realtors is predicting that home values will continue to go up at a rate of 3.1% in 2019.

If you delay your purchase for another year, you’ll have to pay 3.1% more. That’s $9,300 extra dollars for a $300,000 property.

Keep in mind that home values are the lowest in December as sellers accept larger discounts before the end of the year when there are fewer buyers.

According to research by ATTOM Data Solutions December 26 is the best day to close on a home purchase. On that day buyers pay $2,500 less than the value of the home. They also discovered that Ohio buyers realize the biggest discounts in the nation.

Savings by acting now: $9,300 over 12 months plus $2,500.

The High Cost of Renting

If you plan on renting instead of buying you are missing a huge opportunity to build wealth.

The average cost of renting a house in the Buckeye State is $296 more a month than buying (according to GoBankRates.com). This means you would save an extra $3,552 a year by owning the home.

Keep in mind that you’ll have a monthly payment either way. If you own the property, you build equity as you pay off the principal on your loan while the value of your home appreciates at the same time. That’s a double gain you will realize when you sell.

Savings by acting: $35,520 over 10 years.

Recommendations

If you’ve been thinking about buying a home, there’s no better month than December. The potential savings add up to $69,640 over the next 10 years. And that does not even include the future appreciation of your home.

In addition to the savings I explained above you will find incredible incentives from builders who desperately want to sell their inventory homes before the end of the year.

Call or text me TODAY at (614) 975-9650 and let me help you find a great deal in December!