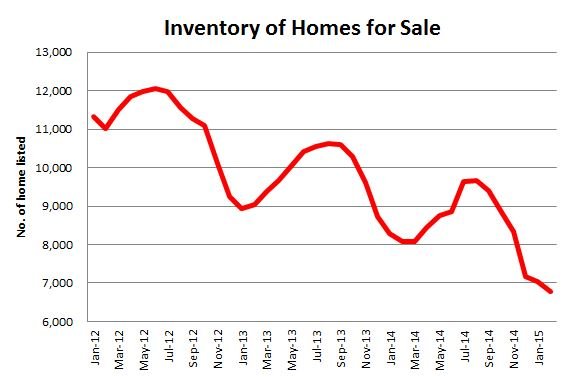

In February 2015 the Columbus housing market has reached new extremes. The inventory of homes for sale has dropped below 7,000. It hasn’t been that low since the early 1990’s. There are only half as many homes listed for sale in 2015, as were during the height of the market in 2005 (10 years ago).

Homes for Sale Inventory below 7,000

The charts below paint a dramatic picture of this dire situation.

Over the past 4 years the number of listings has dropped every month (as compared to a year earlier), in average by 12% a year.

The annual drop in the inventory of homes for sale is even more dramatic, if we display the data on top of each other. Note that the red line represents January and February of 2015, while green shows 2012 data.

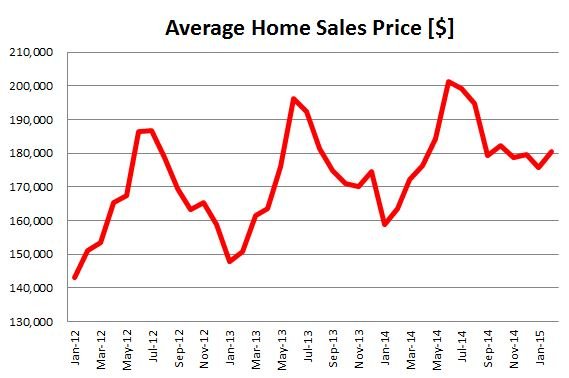

Average Sales Price Increased Since 2012

While the inventory of homes for sale has dropped, more home buyers have moved to Columbus. There’s clearly a lot of demand.

As a result, home values have consistently increased since 2012. In February the average price of a home sold in Columbus was up by 10.4% over February 2014. It reached $180,527, a new record for February sales.

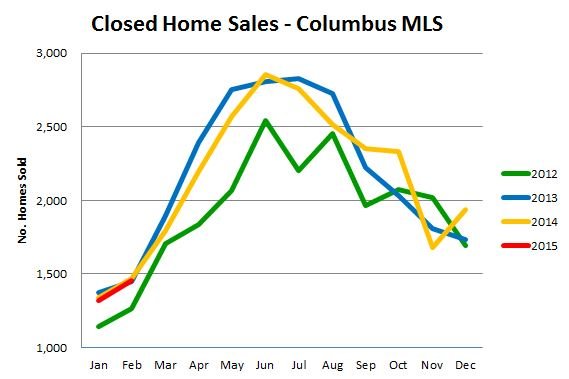

Home Sales Almost Even With Previous Year

Home sales are still lagging behind the past 2 years, but not by much. Columbus Realtors sold 1,453 homes and condos in February 2015, that’s 15 or 1% less than a year ago.

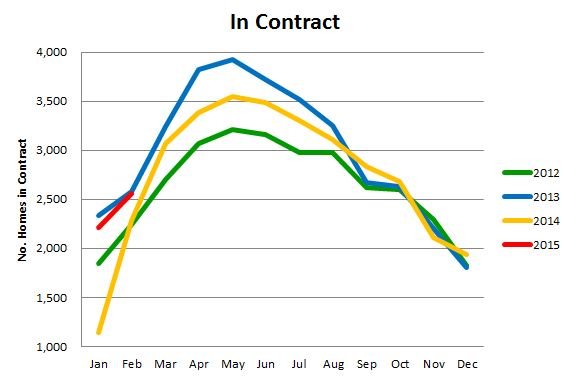

More Listings and Homes in Contract than Last Year

There are encouraging news, though. A total of 2,365 new listings were added to the inventory in February. That’s an increase of 2.5%. It may indicate that more home owners will put their properties on the market this year.

The number of listings currently in contract is a good indication of upcoming closings. We are ahead of last year in this category and almost even with 2013, which was a banner year.

Although pending contracts are an indicator of future home sales, there’s no exact formula. It appears that more contracts fall apart these days. Financing and home inspection are the main culprits.

Sometimes motivated buyers may put a home in contract, but decide to cancel the contract due to the slightest problem with the home inspection. And tough lending guidelines have shattered numerous contracts, even with buyers who had solid pre-approval letters.

The next chart shows pending contracts and closed sales for each month since 2012. In the first half of each year the number of pending contracts was at least 50% higher than the number of closed sales. In Feb 15 we are at the same level like 2013, which was a banner year for home sales.

The National Housing Market

Homes sales increased by 2.2% nationwide in February. This is a good indication of where the Columbus real estate market will be heading (when spring finally arrives.) Home values were up by 5.5%.

Just like in Columbus, the inventory of homes for sales has declined by more than 10% year over year in most metro areas throughout the country.

Some markets, like San Francisco and Denver, are almost completely SOLD OUT with supply levels of only 1.1 months (that’s how long it will take to sell all homes currently listed for sale).

Markets once dominated by foreclosures are catching up, as well. Home values in Detroit rose by more than 20%.

Click here to read the complete RE/MAX National Housing report.

Why are Homeowners Reluctant?

The slow start of the Columbus housing market was mostly due to the cold weather in January and February. Homeowners are somewhat reluctant to list their properties.

There are 3 possible reasons why home owners may delay listing their property.

- Fear of a Quick Sale: With many listings receiving multiple offers within a few days on the MLS, sellers are concerned that they have to pack up and leave home quickly.

- Fear of Not Finding a New Place: As the housing market is so tight, it’s hard for buyers to find a new home. Sellers are concerned that they may have to move out of their existing home before they can find a new place to live.

- Fear of Getting the Property Market Ready: Even in today’s hot seller’s market, homes have to be in perfect shape in order to sell quickly. Kitchens and bathrooms need to be updated. Most of today’s buyers expect a modern style kitchen with granite counters, tiled bathrooms and hardwood floors.

We believe that this is the perfect environment for selling your home and moving up to a larger, more expensive home, because interest rates are still at historic lows and housing affordability was never better.

Leave a comment below and tell us how you feel about the real estate market of 2015, and, if you plan to buy or sell this year.