The Central Ohio housing market finished the first quarter of 2015 with a bang. Columbus home sales skyrocketed to the highest level since 2006. Pending contracts are also substantially higher than a year ago and home values appear to increase at a healthy pace.

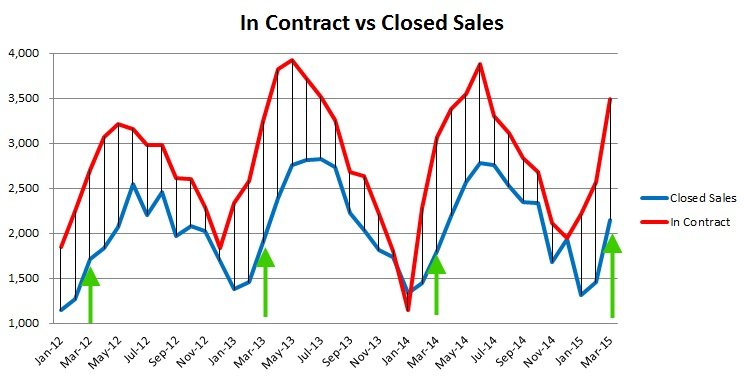

The graphic above compares pending contracts (red) with closed sales (blue). Both show a sharp increase in March. As the green arrows indicate, closed sales and pending contracts are substantially higher in 2015 than in the past 3 years.

Here’s the complete March 2015 Housing Report published by Columbus Realtors.

Inventory Crisis

The stellar number of closed sales, however, resulted in a depletion of inventory. A total of 3,461 new listings were added to the MLS in March 2015. This marks an increase of 46.3% over February.

Unfortunately, this significant increase in new listings did little to stem the ongoing inventory crisis.

While in previous years the inventory of homes for sale started to rise in March, it continued to drop this year (red line). The inventory reached another low with only 6,703 homes listed for sale at the end of the first quarter.

In a booming housing market like today, some home owners may be tempted to delay listing their residence in hopes for an even higher price.

Let’s see if home values are really rising, or, if we are fooled by the numbers and how they are presented to us …

What Happened to Home Values?

When you read the news release that comes with the March 2015 Housing Report, you can see that the average sales price of Central Ohio homes has increased again. It’s up by 3.8% as compared to a year ago.

You are probably wondering, if the value of your home is up, as well (and if it is time to sell?) The best way to find the correct value of your home is to request a free, instant home value report at www.TrueColumbusHomeValues.com

I believe that Columbus home values have leveled off. The average home value has been (almost) the same for the past 7 months (see graphic below).

In previous years, the average sales price has increased month over month beginning in January until July, when the selling season reached its peak. What used to be a seasonal trend has become flat.

That’s why you should not expect a substantial increase in home values this year.

Why Home Values Reached Their Peak

In a free market the price of goods is determined by supply and demand. If that would be the case, home prices should go up every month as the inventory drops.

The inventory has been shrinking since August 2014, when it reached a seasonal high.

During the same time period home values have hardly changed – they have been hovering around $180K for 7 months. Home values have not increased despite of the low inventory.

Why?

Let’s take a look at another report published by Columbus Realtors every quarter – the Lender Mediated Properties Report. Most people don’t pay much attention to this report, however, it holds the answer to the home value puzzle.

Lender mediated properties (bank-owned, HUD homes, short sales, foreclosures) are distress sales. They are offered and sold below the price of a normal residential sale. In the first quarter of 2015 the median sales price of a lender mediated home was only $70,600, while the median price of a traditional sale was $165,100.

Over the past year we saw lender mediated sales drop by 21.7%. Currently, only 19.6% of Columbus home sales are considered lender mediated (as compared to 50% in 2011).

A major reason for the quick rise of the average sales price was the drop in foreclosure sales, NOT the actual increase in home values.

While the price of lender mediated properties has increased substantially, the sales price of traditional homes did not change much.

As they comprise only a small portion of all sales, the low values of lender mediated sales have less impact on the combined average sales price.

You Need to List Now

If you’ve been on the fence, do not delay putting your house on the market. The value of your home will most likely not increase much this year. Home values may actually drop, if more home owners pick up on the fact that home prices have been level for 7 months. There’s a good chance the inventory of homes for sale will increase, resulting in more choices for buyers and less incentives to overpay.