Many homeowners are wondering if property values will decline and whether inexpensive, bank-owned properties will flood the market after the foreclosure moratorium expired June 30, 2021.

We’ve seen reports of a “significant increase in foreclosure filings”. So, let’s explore what this means for the housing market and the value of your property?

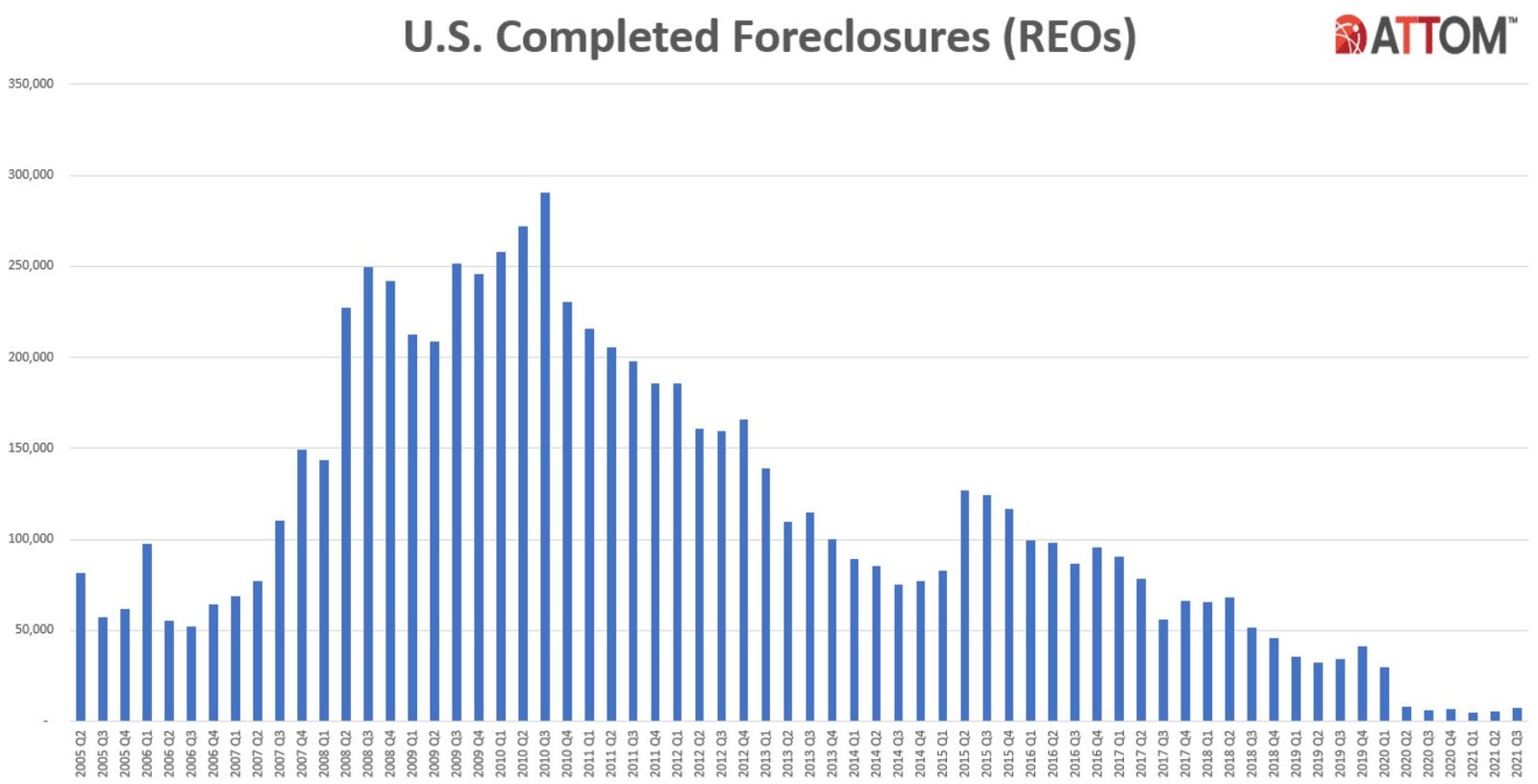

Foreclosure Starts & Completions Over 15 Years

Foreclosure starts peaked in Q1 of 2009. They were fueled by the melt-down of the subprime mortgage market in 2007 and 2008. Zero down payment loans, no income verification, and a surplus of new built homes were to blame.

The mortgage meltdown had a significant impact on property values, which left many homeowners underwater.

Since the days of the Great Recession foreclosure starts have fallen dramatically, as you can see below (click on the chart to enlarge it).

The Moratorium Slows Foreclosures to a Trickle

A foreclosure moratorium was imposed in March of 2020 when Covid started to spread in the US. It stopped foreclosures on all federally-backed mortgages (around 70% of all home loans) for one and a half years.

After the moratorium expired at the end of June 2021 lenders submitted foreclosure filings on 25,209 U.S. properties in Q3. That’s far below the roughly 570,000 foreclosure starts we saw in Q1 of 2009.

Foreclosure starts were 32% higher than in Q2 and up by 67% from a year ago.

The next chart shows that only 50% of all foreclosure starts are completed and become REOs (click on the chart to enlarge).

Foreclosures in Ohio

One in every 2,002 housing units faced a foreclosure filing in Ohio in Q3. That’s higher than the national average, where 1 in every 3,019 homes had a filing.

Compared to Q3 of 2020, however, foreclosures increased by only 16.29% in Ohio – which is much lower than the 68.48% rise nationwide.

How Many Borrowers Face a Foreclosure Filing?

Almost 10% of all homeowners took advantage of the foreclosure moratorium when the pandemic began. They entered into a forbearance agreement with their lender and stopped making mortgage payments.

At the beginning of October 2021 only 2.62% of borrowers were still in forbearance. It is estimated that 16% of them can no longer afford to make loan payments and face a foreclosure filing.

Why Foreclosures Won’t Impact Home Values

Many homeowners facing foreclosure have enough equity in their properties to sell on the open market and avoid being repossessed by the bank.

Only a small number of properties will become REO’s (bank-owned properties). Cash investors will likely buy most of them to fix and flip or to turn them into rentals.

There will be no negative impact on home values.

Talking About Home Equity …

Do you know how much cash you could get when you sell your home?

I am not talking about the value of your property. I am talking about the amount of money you’ll get at the closing table.

If you want to find out how much you will yield from the sale of your home, call or text me today at (614) 975-9650 for a Personal Equity Analysis. It’s free!

Call or Text me NOW at (614) 975-9650!