According to a report from the Federal Reserve the net worth of homeowners is 40x higher than the net worth of renters. This makes home ownership the single best way to create wealth for most families.

Let me show you exactly how it works.

Homes Appreciate Consistently

In average, home values have appreciated in value over any 10-year period since World War II – even during the Great Recession.

The average sales price of a Columbus home has increased by $104,471 in the past 10 years.

- 2010: $160,020

- Oct 2020: $264,491

That’s a 65.3% gain, which equals an annual return (ROI) of 5.2%.

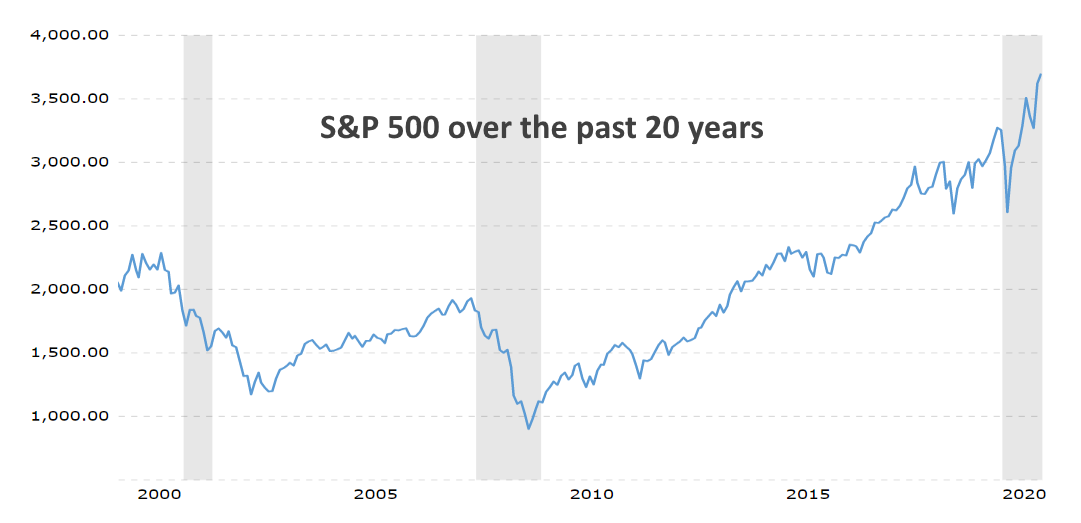

Home Values vs. the Stock Market

A 5.2% return does not sound like a lot when compared to the stock market.

The S&P 500 rose from 1,176 to 3,440 since 2010. That’s 11.4% per year.

However, the stock market is very volatile. The S&P 500 lost value between 2000 and 2010 – this means no gain for 10 years.

Is the ROI of your home only half of the stock market?

That is only correct if you pay cash for your house. However, most people get a loan for their purchase, which gives them leverage.

Leverage is the Key to Creating Wealth with Real Estate

Let’s assume you pay 20% down.

In 2010 the average down payment was $32,004 (20% of $160,020). The remaining 80% is financed with a 30-year mortgage at 4.7% (the average interest rate in 2010).

In 2020 your home’s value has increased to $264,491. Your total gain is:

- value appreciation: $104,471

- pay-down of mortgage: $25,242.

Your total gain is $129,713 – that’s 4.1 times your down payment.

Your down payment has grown at a rate of 15.0% per year.

You easily beat the stock market.

Low Down Payment Means Higher Returns

Now imagine you get an FHA loan which requires only 3.5% down.

- Your initial investment (down payment) would be $5,601.

- Your principal payoff after 10 years is $30,448

- Your total gain comes to $134,919 – that’s 24.1 times your original investment.

- Your annualized return is a whopping 37.5%.

That’s how you create wealth by owning your own home!

Next week I will address monthly mortgage payments and how they compare to rent payments.

You will discover that mortgage payments are less expensive than paying rent and how your home loan is a “secret savings account”.

Are You Ready to Terminate Your Lease and Buy? Call or Text me TODAY at (614) 975-9650.