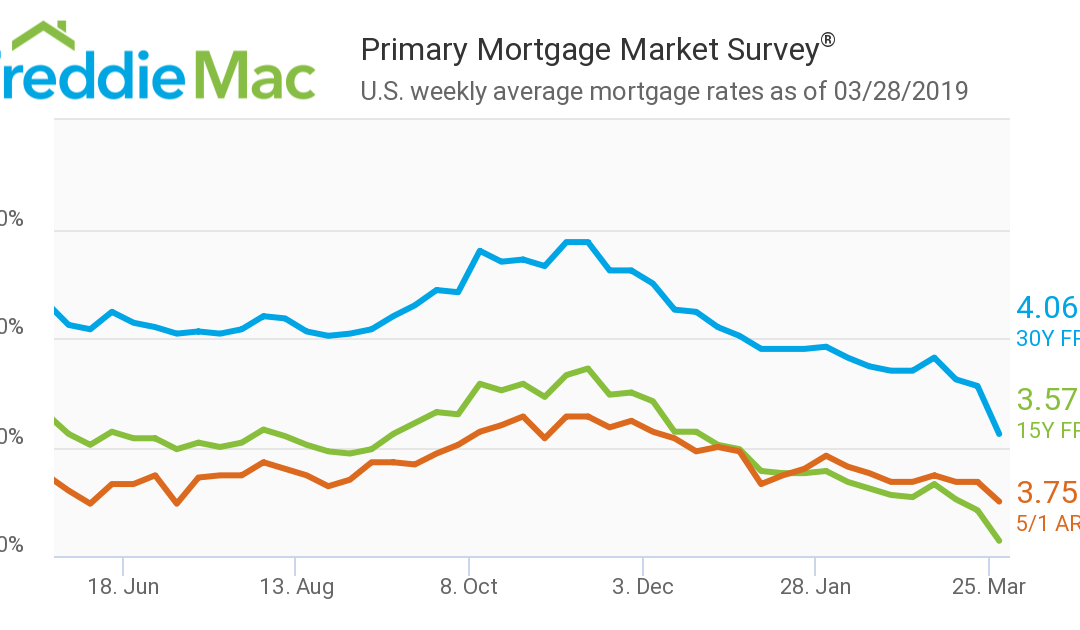

Last week the average interest rate for a 30-year fixed mortgage dropped to 4.06%. A year ago, it was around 4.40%. According to CNBC this is the largest decline in 10 years.

The drop-in interest rates was somewhat surprising. Most experts have predicted rates above 5% for this year.

How New Rates Impact Your Mortgage Payment

Lower interest rates are great news for home buyers who have been fighting quickly rising home prices.

Let’s assume you borrow $200,000 from a bank. Your mortgage payment at 4.40% would be $1,002 a month (principal and interest, not including taxes and insurance).

At today’s lower interest rate of 4.06% your monthly payment would go down to $962.

You save $40 a month, $480 per year, or $14,400 over the lifetime of the loan.

Has Your Affordability Increased?

The average sales price has increased by 4.7% since February 2018. A home that cost $200,000 a year ago would sell for $209,400 in 2019.

For the $200,000 home you would have paid $1,002 per month a year ago, assuming you get 100% financing at a 4.40% interest rate.

Today you would have to get a $209,400 mortgage to buy the same house. At the lower interest rate of 4.06% your monthly payment would be $1,007.

Your monthly payment only increased by $5, so your affordability is the same as a year ago.

Don’t wait till interest rates go back up again!

Call or text me TODAY at (614) 975-9650 and let me help you find your dream home!