You may have seen articles comparing the cost of leasing vs. owning a home.

Most of these articles simply compare the monthly mortgage payment to your lease payment and proclaim that the lower one wins.

This comparison is wrong.

It completely misses the incredible wealth building power of the rising equity position you build in your home when you own.

How Much Equity Did Homeowners Gain?

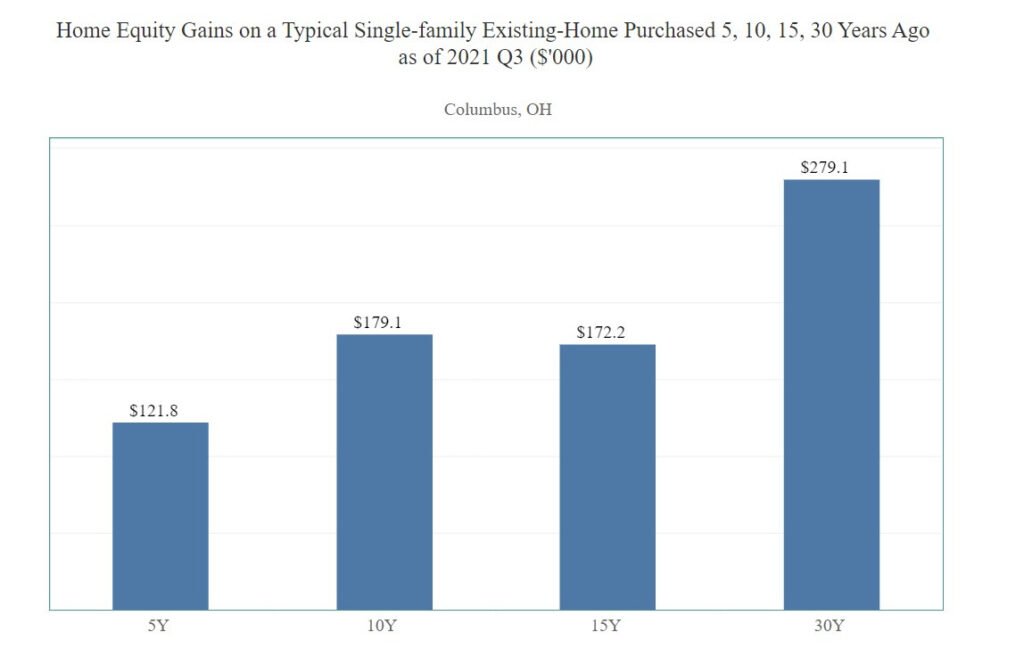

The National Association of Realtors just released a report that shows how much equity the average homeowner gained in the past 5, 10, 15, and 30 years.

Here are the numbers for Columbus:

A Combination of Price Gain and Loan Payoff

In Columbus the total 10-year equity gain was $179,100.

There are 2 parts to this gain:

Price Appreciation: $154,800 – that’s how much home values increased over the past 10 years. It corresponds to an annual gain of 8.1%.

Principal Payoff: $24,300 – the amount your loan balance decreased from monthly mortgage payments.

In the next chart you can see how the median home value changed:

You will notice that the 15-year gain is somewhat lower. If you purchased your home in 2006, you would have paid a premium during the height of the housing market. This bubble, sparked by sub-prime mortgages, burst in 2007.

Rents Skyrocket with Inflation

While you can lock in your monthly mortgage payment for 30 years, your lease will keep going up with inflation.

Today’s inflation is the highest is has been in 40 years. In 2021 alone rents have increased by a staggering 17.8% nationwide.

Below you can see how the median asking rent has changed since 1988.

Now is the Time to Buy and Stop Renting

If you would have purchased a home 10 years ago you would be $179,000 richer today. Even if you purchased 2 years ago you would own a lot of equity.

The next best time to buy is NOW!

Become a homeowner in 2022, lock in a low, fixed interest rate to beat inflation, and take advantage of quickly rising home values. In a few years you will have gained equity from home value appreciation and mortgage paydown.

If you continue leasing your rent will increase every year, while you pay your landlord’s mortgage. He or she will thank you for helping them build equity in their rental property.

Cash Out Your Equity and Move Up

If you purchased your home two or three years ago you likely gained a lot of equity. Now is a great time to cash out and re-invest the gain in a larger, more expensive home.

Let me help you with a professional equity assessment of your home, so you know exactly how much cash you will gain when you sell!

Call or text me today!

Whether you want to move up or stop leasing!

Call or Text me TODAY at (614) 975-9650!