When it comes to selling your home, you probably think about spring and summer. That’s when most buyers are searching for a new place. Spring listings are in hot demand, often resulting in multiple offers and bidding wars. When you list your home during the spring buying/selling season, you may get bids above asking price.

But there’s a downside – when you sell your home, you have to find a new one, and you will be competing with everyone else in the crowded spring housing market.

Why You Should List Your Home in December

Buyers are looking for homes throughout the year. Unlike any other month, December offers distinct benefits for home sellers. Here are 7 reasons why selling during the Holiday Season is a good idea …

- People who look for a home in December are serious and ready to buy.

- There are fewer homes on the market, so there’s less competition.

- More people list their home in January and February. More choice for buyers means less money for sellers.

- Homes decorated for the holidays show better.

- Buyers have more time to look for and visit properties during the holidays.

- You are in control. You can restrict showing hours based on your schedule.

- You can sell your home in December (for more money) and move in January.

Click on this picture to see the 7 Reasons to List during the Holidays Infographic (by Tom Ferry).

Rising Interest Rates will Benefit December Listings

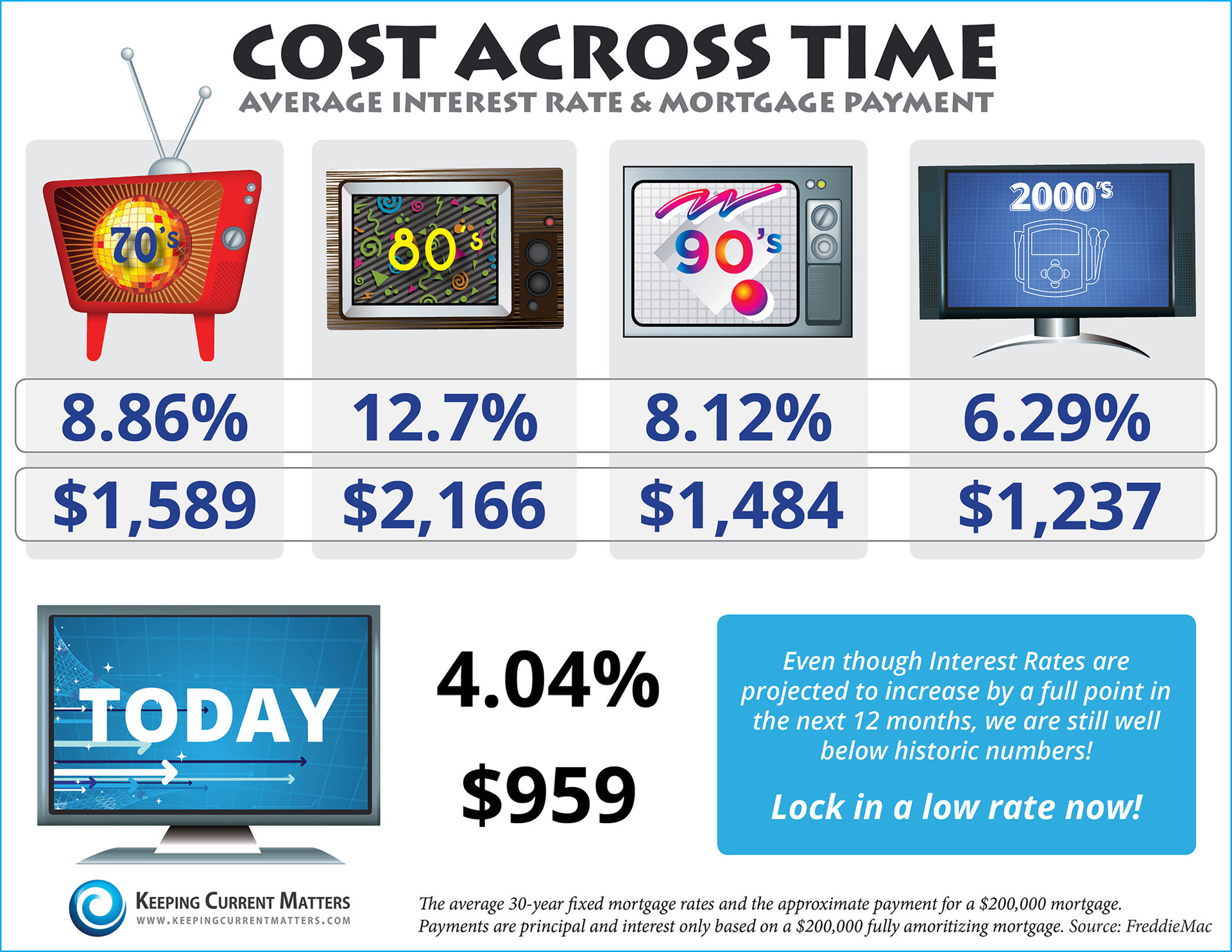

You will probably get more money for your home while interest rates are still at historic lows. The Fed has promised to raise interest rates by the end of the year. Major lenders, such as Freddie Mac, are forecasting an increase in mortgage loan interest rates by 1 percentage point over the next 2 months.

This means buyers will have to settle for a smaller home or offer less.

This graphic (by KCM) shows the average interest rates and mortgage payments for the past five decades. You can clearly see: homes have never been as affordable as today!

Even a small increase in interest rates may substantially raise your monthly mortgage payment. Home affordability will go down. And there’s a chance that home values may drop in 2016.